November 2021 is a Seller's market!

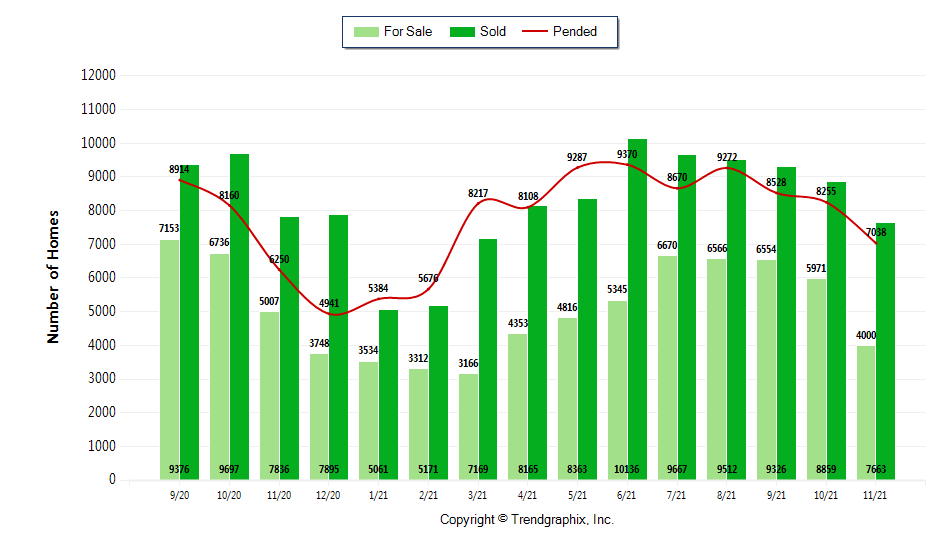

The number of for sale listings was down 20.1% from one year earlier and down 33% from the previous month. The number of sold listings decreased 2.2% year over year and decreased 13.5% month over month. The number of under contract listings was down 14.7% compared toprevious month and up 12.6% compared to previous year. The Months of Inventory based on Closed Sales is 0.5, down 15.7% from the previous year.

The Average Sold Price per Square Footage was the same as compared to previous month and up 19.5% compared to last year. The Median Sold Price increased by 0.8% from last month. The Average Sold Price also decreased by 0.9% from last month. Based on the 6 month trend, the Average Sold Price trend is"Depreciating" and the Median Sold Price trend is "Neutral".

The Average Days on Market showed a upward trend, a decrease of 25% compared to previous year. The ratio of Sold Price vs. Original List Price is 102%, an increase of 2% compared to previous year.

It is a Seller's Market

Property Sales (Sold)

November property sales were 7663, down 2.2% from 7836 in November of2020 and 13.5% lower than the 8859 sales last month.

Current Inventory (For Sale)

Versus last year, the total number of properties available this month is lower by 1007 units of 20.1%. This year's smaller inventory means that buyers who waitedto buy may have smaller selection to choose from. The number of currentinventory is down 33% compared to the previous month.

Property Under Contract (Pended)

There was a decrease of 14.7% in the pended properties in November, with 7038 properties versus 8255 last month. This month's pended property saleswere 12.6% higher than at this time last year.

November to February a great time frame opportunity for buyers and sellers. Stop saying “it’s just a bad time” you got to be smart about it. You can only lock in a rate once you’re under contract and mutual acceptance. But be careful because stock market goes up and down all day. We are always seeing movement in the market. Make a decision today puts you ahead of the game. Feds indicated that they may start pulling back on mortgage-backed Securities that’s called MBS

Feds don’t control the market rates. Mortgage rates going up VS what pricing is doing - goes side by side. It’s important to watch closely the movements of the stock market.

Don’t slow down, even if the market goes up and down. Prepare yourself and look for some extra little things you can do to set yourself apart from others sellers. This is the best time to consider looking at buying a home you want. Mortgage is trending in an upward direction right now. New money means new purchase. 2022 is still going to be a very aggressive market. Seller wants to sell. Sellers are more open to alternative as far as pricing terms and things. Now is the right time to buy and sell a house! Do not over price your home. List price VS value price. No home will sell for less than market value in a limited inventory market. The buyers know what value is. Seasonal slowdown has a significant adverse effect on people’s buying, it has a massive impact to buyers and sellers

Numbers for new listings, pending sales, and closed sales were comparable to year-ago totals, while prices rose a little more than 15%. The so-called seasonal slowdown normally sees serious buyers gain an advantage over casual buyers who take a break during the holidays. The difference this year is that there are fewer buyers taking a break and demand remains high. NMLS figures show 8,571 pending sales across 26 counties last month, nearly matching the year-ago total of 8,584 mutually accepted offers. The 8,976 closed sales marked a slight improvement on twelve months ago when MLS members tallied 8,875 completed transactions (up 1.14%). Waived inspections and funds committed upfront in the event of a low appraisal are not as common, but sellers still have the upper hand. Buyers still need to be very bold and very intentional with their offers. Typically, we see a lull of sales activity during late fall and into early winter. While there are fewer transactions at this time of year, the intensity for each new listing going under contract is extremely high).

Twenty of the 26 counties in the NWMLS report added more new listings during November than a year ago, but with demand outstripping supply, inventory was meager in many areas. Area-wide, there were 4,621 active listings of single family homes and condominiums at month end, down nearly 29% from a year ago when there were 6,505 listings. The selection at month end amounted to about two weeks of supply (0.51 months). Five counties had even less supply: Snohomish (0.24 months), Thurston (0.35) King (0.38 months), Clark (0.39) and Pierce (0.44 months). The pandemic continues to put pressure on home sales and prices. Historic low inventory is still influencing multiple offer situations in King, Snohomish and Pierce counties.

Increasing interest rates have not slowed the pace of sales. Lifestyle changes and a strong job market will continue to drive the market into 2022 and beyond. To put this into further perspective, King County had only 1,149 active listings at the end of November - the lowest - and a 90% decrease since November 2010 when there were 11,867 active listings. This is hampering existing sellers from moving up. Baby boomers find themselves in large homes and not needing the space, but they are hesitant to sell without a place to go should they want to stay in the region. On a brighter note, new financing options are expected to develop during 2022, the "modern bridge loan," which would give homeowners the ability to sell their current residence after they've found and purchased their new home. Every year has its own market dynamics, but with seasonal similarities most years.

Given what has been the extreme shortage of inventory in the Seattle market, there is currently a seasonal market opportunity for Seattle urban shoppers for condominiums and townhomes. Homes are coming off the market faster than they are coming on. We have, however, seen a decrease in the number of multiple offers on new listings, and we continue to see steady open house traffic.

With this fast-paced market, if a seller puts their home on the market in early December when there are fewer listings but still a lot of buyers, it could likely be off the market by Christmas. Builders and developers are scrambling to bring on new inventory in all sectors. The current inventory, with only 0.57 months of supply, is "drastically low and fueling the increase in median prices."

Kitsap County is a great value and a magnet for surrounding communities with loads of infrastructure improvements and companies moving into the area. MLS figures show the median price in Kitsap County, at $500,000, is about two-thirds of the median price in King County ($740,000). The return to these suburban areas seems to continue unabated as first-time buyers seek value and those seeking a more relaxed lifestyle are taking advantage of low interest rates. Area-wide, the November numbers were pretty much what was expected with the market starting to slow as we move into the winter.

Recent adjustments in Federal Housing Finance Agency (FHFA) limits for conforming loans (mortgages backed by Fannie Mae or Freddie Mac), which included a record 18% jump in most markets, but also an increase from $776,250 to $891,250 in the higher-cost tri-county area encompassing King, Pierce and Snohomish counties will be a further boost to more expensive markets.

Navigating Forbearance - Refinance or Purchase.

George Moorhead of Bentley Properties talks every weekend about Inflations Causing Rates, Is The Real Estate Market Crashing? Top 5 Things You Need To Look For When Getting Mortgage Rates.

For more Real Estate News and Tips, please tune in to our Facebook Live every Saturday at 10AM

Follow us on Facebook: George Moorhead Bentley Properties

If you have any questions or comments you would like answered in next month's newsletter, email me at [email protected] and they will be included in the market update. OR if you would like more information on our unique systems and programs, call us at 425-236-6777 Or visit our website www.GeorgeMoorhead.com

GEORGE MOORHEAD - Bentley Properties

[email protected]

Direct: 425-236-6777

14205 SE 36th St., Suite 100, Bellevue WA 98006

www.GeorgeMoorhead.com